Right now stock markets are climbing to all time highs, at a time when productivity, demand, and worker participation are at all-time lows. Add to that, ageing demographics implies higher societal welfare costs draining discretionary expenditures. While stocks are individual gambles, they are all operating now in the same investing climate which should dictate profit selling and reducing positions in line with expectations.

Yet stocks are rising and indices are all-time in the US. This is a contradiction. The macro reason is the ultra-liquidity in larger organizations needs to go somewhere and bonds are becoming guaranteed money losing investments. This is the reality, so people are betting on companies to at least keep their money safe. Fat chance.

The flight to safety/ quality is a lemming charge off the cliff, the eventual stupidity of investors.

Right now, lemmings are overconfident in the outcome of the US election, where if Trump or Clinton win there will be dramatic changes to policy and directions the nation takes. The volatility level is surprisingly low for an election year, where zero hedge indicates they must think central banks will save them.

Even if your stocks are in profitable companies, even if they execute at 80% to 100% of forecast, they are still able to return to investors %5 on investment. Why is this a problem? Right now companies are using stock buy-backs to gin up returns and keep their options profitable.

Can anyone tell me what the 5% yield means to a stock that has increased 100%? Yes, that yield - ignoring specifics - for the investor buying at twice the price is 2.5%. You are paying far more and getting far less.

Which constituency has the greatest impact when investors run up the stocks' prices? Yes, insiders with options; exactly the wrong people you want to profit from your money. Their sales will be guaranteed, your money is not.

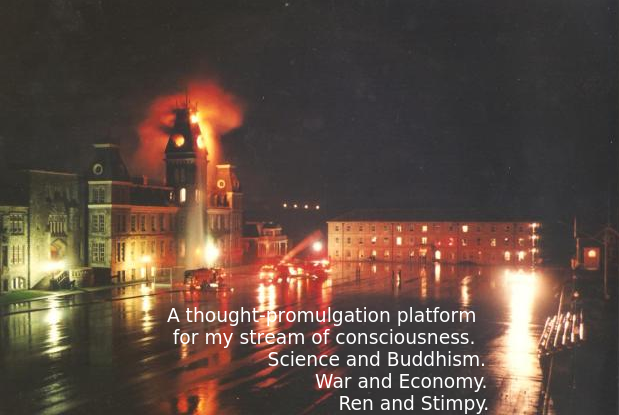

When Icahn, Marc Faber, and Welch as proven industrial captains are warning of collapse it's not a question of if but when. This is the summary of economics right now:

And yet, this flight may cause the bubble to burst. All it takes is one massive institutional investor to swamp sell out. If you invest in these stocks you are risking 100% of your money with a slim chance of half returns. Insiders will make a profit and you might not be able to sell in time to get out. Yes, I concede the volatility might gain you a profit in the short term if you are smart and fast enough. How many are both of these? Most are investing on "hope" and that's why they fail.

My definition of stupidity is fighting old battles: not learning from history how to avoid dangers. The 2008/2009 bubble was seen and people did not respond in time to avoid. The graphs are aligning to 2008 proportions.

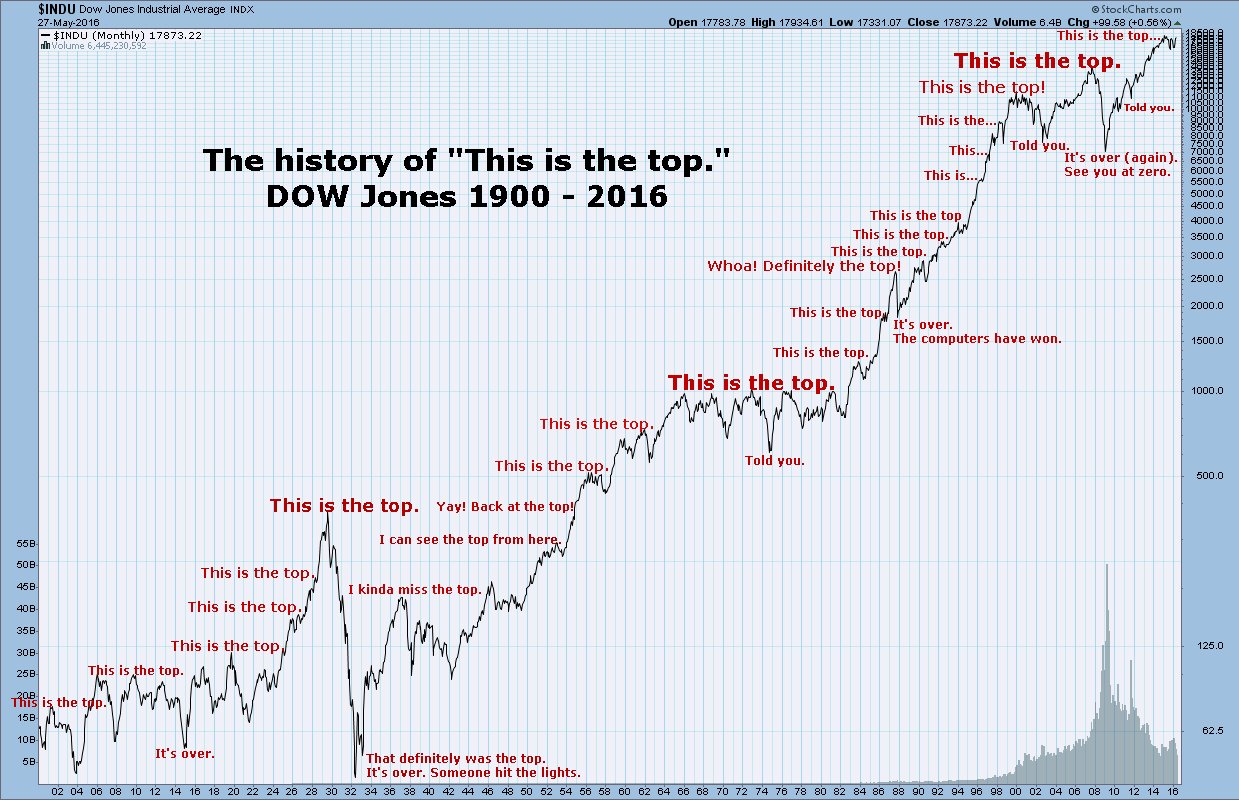

Yet another graph with data one can't spin:

Here's another astute investor pointing out it is interest rate hikes - with so many industries depending on cheap money and massive leverage - that is the single biggest risk to future profits and even business as usual. Hanjin is not the only company that will go bankrupt through over-leveraged operations.

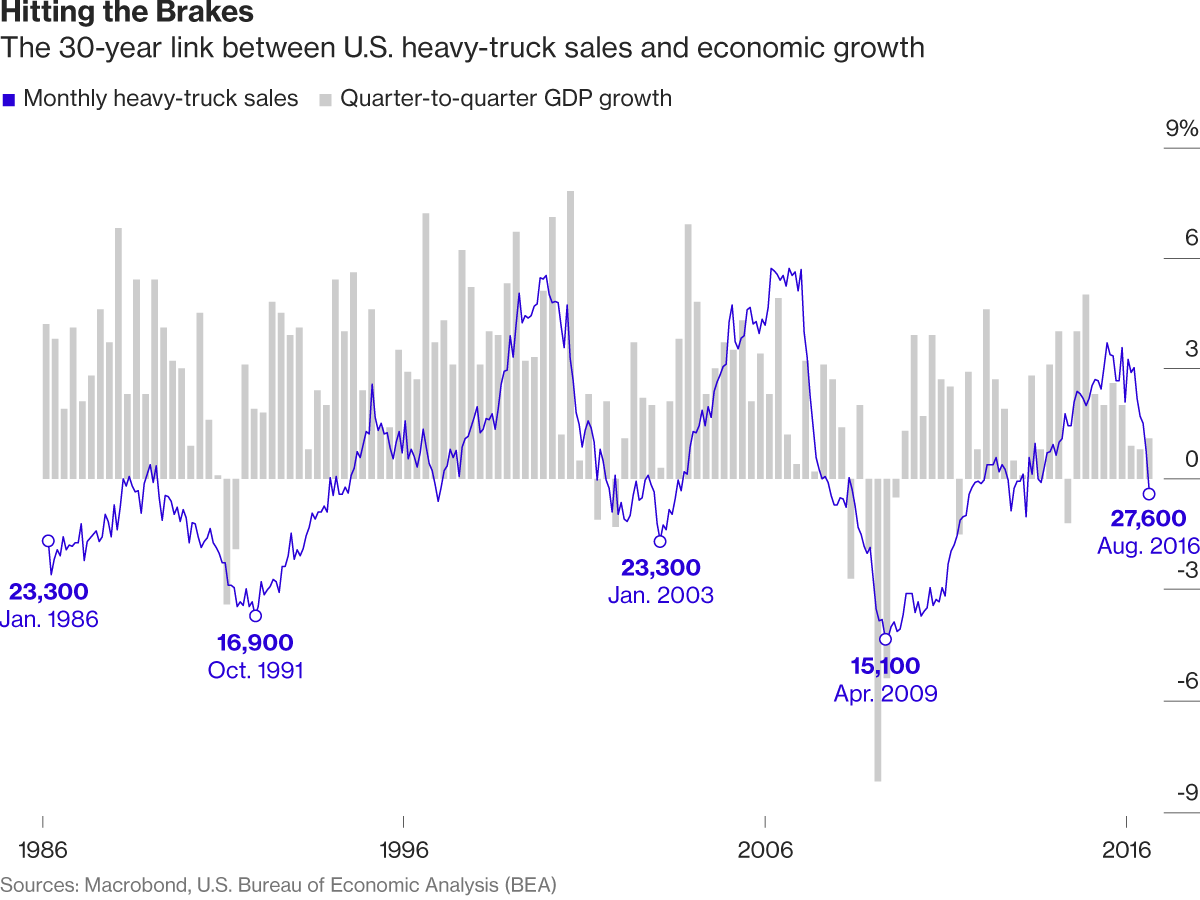

Even truck purchases indicate a recession is underway.

More evidence the market is in overhang mode, last week there were two inside weeks in a row. That is a black swan-type unusual event heralding doom conditions.

Jim Cramer thinks it's turned market sentiment that is punishing under-performing stocks. It's not; cautious people are sniffing around the edges of the next financial collapse. Poor performing stocks are the canary in the coal mine. Savvy investors are not rushing back into stocks if they suspect bad news might trigger a huge drop. That's not bad sentiment, it's people paying attention!

Here's a smarter play, pull out your money and wait till these stocks crash. That's a guaranteed way to increase your yield buying in the trough not on the the bow wake. Rebuy at reasonable prices is a smart play.

Riskier for those with balls, short Apple, Google, and Facebook.

Yet stocks are rising and indices are all-time in the US. This is a contradiction. The macro reason is the ultra-liquidity in larger organizations needs to go somewhere and bonds are becoming guaranteed money losing investments. This is the reality, so people are betting on companies to at least keep their money safe. Fat chance.

The flight to safety/ quality is a lemming charge off the cliff, the eventual stupidity of investors.

Right now, lemmings are overconfident in the outcome of the US election, where if Trump or Clinton win there will be dramatic changes to policy and directions the nation takes. The volatility level is surprisingly low for an election year, where zero hedge indicates they must think central banks will save them.

Even if your stocks are in profitable companies, even if they execute at 80% to 100% of forecast, they are still able to return to investors %5 on investment. Why is this a problem? Right now companies are using stock buy-backs to gin up returns and keep their options profitable.

Can anyone tell me what the 5% yield means to a stock that has increased 100%? Yes, that yield - ignoring specifics - for the investor buying at twice the price is 2.5%. You are paying far more and getting far less.

Which constituency has the greatest impact when investors run up the stocks' prices? Yes, insiders with options; exactly the wrong people you want to profit from your money. Their sales will be guaranteed, your money is not.

When Icahn, Marc Faber, and Welch as proven industrial captains are warning of collapse it's not a question of if but when. This is the summary of economics right now:

And yet, this flight may cause the bubble to burst. All it takes is one massive institutional investor to swamp sell out. If you invest in these stocks you are risking 100% of your money with a slim chance of half returns. Insiders will make a profit and you might not be able to sell in time to get out. Yes, I concede the volatility might gain you a profit in the short term if you are smart and fast enough. How many are both of these? Most are investing on "hope" and that's why they fail.

My definition of stupidity is fighting old battles: not learning from history how to avoid dangers. The 2008/2009 bubble was seen and people did not respond in time to avoid. The graphs are aligning to 2008 proportions.

Yet another graph with data one can't spin:

Here's another astute investor pointing out it is interest rate hikes - with so many industries depending on cheap money and massive leverage - that is the single biggest risk to future profits and even business as usual. Hanjin is not the only company that will go bankrupt through over-leveraged operations.

Even truck purchases indicate a recession is underway.

More evidence the market is in overhang mode, last week there were two inside weeks in a row. That is a black swan-type unusual event heralding doom conditions.

Jim Cramer thinks it's turned market sentiment that is punishing under-performing stocks. It's not; cautious people are sniffing around the edges of the next financial collapse. Poor performing stocks are the canary in the coal mine. Savvy investors are not rushing back into stocks if they suspect bad news might trigger a huge drop. That's not bad sentiment, it's people paying attention!

Here's a smarter play, pull out your money and wait till these stocks crash. That's a guaranteed way to increase your yield buying in the trough not on the the bow wake. Rebuy at reasonable prices is a smart play.

Riskier for those with balls, short Apple, Google, and Facebook.

No comments:

Post a Comment